Stellar (XLM), which surged over 100% in the past week, has now witnessed a sharp decline in Open Interest. This drop in XLM Open Interest indicates waning enthusiasm among derivatives traders, potentially indicating a weakening in the recent rally’s momentum.

Although holders may remain optimistic, on-chain analysis suggests that XLM’s price could face a significant correction if the current market condition does not change.

Stellar Market Dominance Fizzles

On November 24, XLM Open Interest climbed above $339 million, which was an all-time high. As reported earlier, this massive interest in the altcoin is linked to the surge in Ripple (XRP) price.

However, as of this writing, the OI, as it is commonly abbreviated, has fallen to $209 million. This drop indicates that traders have closed previously open contracts worth $130 million. Unsurprisingly, this decline coincided with XLM’s price decrease, which caused it to lose 10% of its value in the last 24 hours.

.divm, .divd {display: none;}

@media screen and (max-width: 768px) {.divm {display: block;}}@media screen and (min-width: 769px) {

.divd {display: block;}}

Sponsored

From a price perspective, the drop in OI means buying pressure in the derivatives market has decreased. Hence, if the OI value continues to decline, then XLM’s price is likely to fall below $0.45.

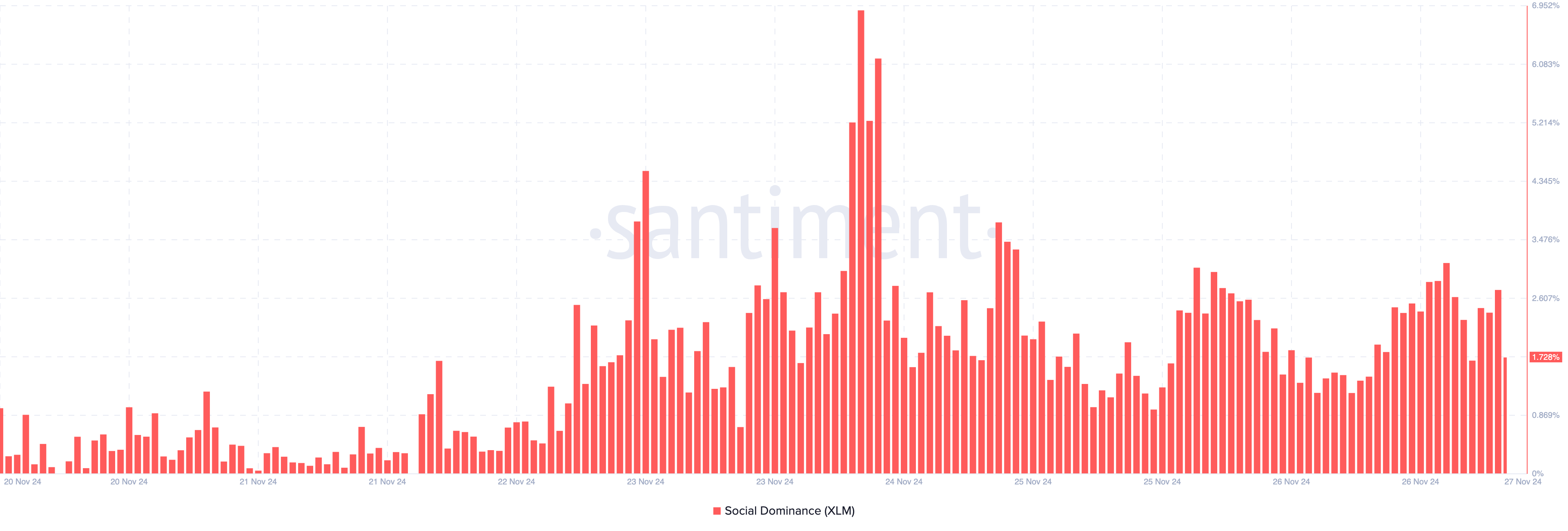

Another bearish signal for Stellar is its declining social dominance. This metric evaluates the proportion of discussions about a cryptocurrency compared to the top 100 assets. When social dominance rises, it typically indicates heightened market interest and demand. Conversely, a decline suggests diminishing attention and potentially lower demand.

A few days ago, XLM’s social dominance was at 3.13%. However, it has dropped significantly to 1.73%, implying that market participants are shifting their focus to other assets. If this trend persists, it could lead to further price drops for XLM.

XLM Price Prediction: Push Back to $0.28 Likely

If the declining OI and social dominance continue, XLM may struggle to sustain its recent gains. On the daily chart, the Money Flow Index (MFI) reading has dropped. The MFI measures buying and selling pressure and tells if an asset is overbought or oversold.

When the reading is above 80.00, it is overbought. But when it is below 20.00, it is oversold. As seen below, the MFI hit the overbought zone earlier before it retraced. Considering the current condition, XLM’s price could decline to $0.28.

However, a break below the $0.22 support level could push the price down to $0.17. On the flip side, if buying pressure increases in the derivatives and spot market, this might not happen. Instead, XLM could rally to $0.64.

.aff-primary {

display: none;

}

.aff-secondary {

display: block;

}

.aff-ternary {

display: none;

}

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Sponsored

#placement_727536_0{ width: 100%;

height: 100%;}

#placement_727536_0_iframe{ width: 100%;

height: 100%;}

Sponsored

40 mins ago

1 hour ago

2 hours ago

3 hours ago

4 hours ago